Florida schools will soon teach money management. This Pensacola lawyer helped it happen.

Pensacola News Journal | By Colin Warren-Hicks | March 28, 2022

If you’ve ever wondered why schools teach trigonometry but not how to balance a checkbook, this law is for you.

Last week, Gov. Ron DeSantis created a new graduation requirement for Florida high school students aimed at improving their personal finances.

On Tuesday, DeSantis signed SB 1054 into law, mandating that all Florida high school students take at least one-half credit in financial literacy and money management before receiving a diploma.

The “Dorothy L. Hukill Financial Literacy Act” will come into effective at the beginning of the 2023-2024 academic year for students entering ninth grade.

And there is a Pensacola-based bankruptcy attorney who is absolutely thrilled about it.

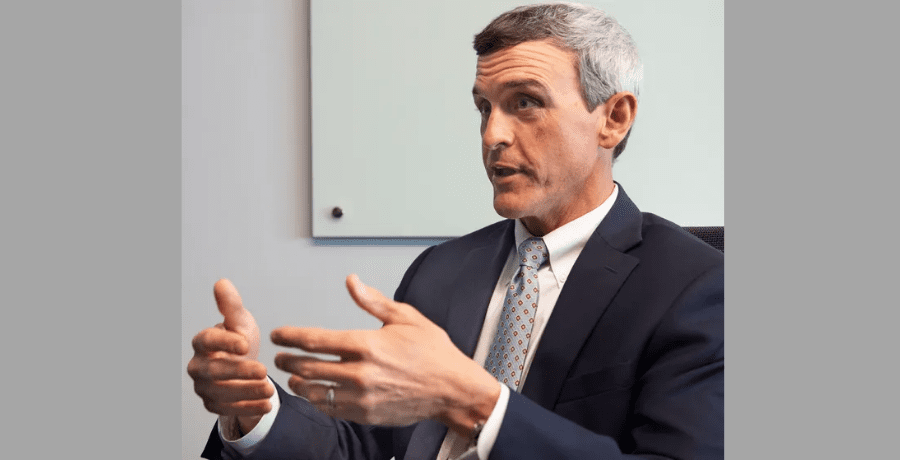

Douglas Bates, who practices business litigation and handles bankruptcy cases with the Clark Partington law firm in downtown Pensacola, has been advocating for and working to advance legislation aimed at improving the financial knowledge of Florida citizens for over a decade.

“There are 67 counties in the state of Florida and all of them have high schools, and now, all those high schools are going to be teaching financial literacy to students who will hopefully grow up in the state of Florida and stay in the state of Florida and have a positive impact on the state of Florida in ways we don’t even know,” Bates told the News Journal. “This bill is going to lay groundwork for them to be well-educated in personal finance.”

Bates is the chair-elect for the Business Law Section of The Florida Bar, a small group of Florida business attorneys who meet three times a year and often advocate for changes in state corporate or state tax or just general state business-related laws.

The Business Law Section has been championing the idea of a required course on personal finance to state legislators since 2013, Bates said.

“But this particular financial literacy concept is one that we’ve been working on since the early 2000s,” Bates said. “In 2004, we started teaching financial literacy courses throughout the state of Florida, going to schools — mostly high schools.”

Bates said when other business litigators and judges started going out into high schools and directly spoke to students about financial literacy, they were stunned by those students’ lack of knowledge.

“What we were learning over and over again with them was that we really need to improve the garden variety financial literacy in the state of Florida,” he said. “While we’re teaching these courses, we’re seeing that there’s a real need for it.”

Many of the hundreds of high schoolers who Bates and his colleagues have spoken to over the years were at first unable to define simple financial terms such as “deposit,” “interest rate” or the even word “interest” by itself.

His classroom experiences taught Bates and his colleagues that “the basics of budgeting, bank statements, credit cards, what is interest, how to balance the checkbook, those sorts of personal finance and those things that may get lost if a student isn’t actually taught them,” he said.

In 2019, legislation was passed that made a high school course on financial literacy an elective option, according to Bates.

But, now, the “Dorothy L. Hukill Financial Literacy Act,” named in honor of the late state senator who unsuccessfully sponsored similar past legislation, has turned an elective into a requirement.

According to the bill, students will be required to take one-half credit in personal financial literacy and money management involving such subjects as types of bank accounts offered, completing a loan application, basic principles of personal insurance policies and types of savings and investments accounts.

“I think it’s going to be a very helpful course for our students,” said Tim Smith, superintendent for the Escambia County School District. “Having it required for all students will prepare our students for when they move into adulthood and look at how to manage household finances, how to work with apartment rentals, home purchases, leases, getting a car, loans, those types of things, and I think it is a great idea to equip our students to learn those finical concepts.”

He added, “Financial management is very important for people, especially for when they start that young early adulthood. We know that people who save, for example, consistently for the long-term, starting in their early 20s provides opportunities in the future.”

The “Dorothy L. Hukill Financial Literacy Act” was sponsored by state Sen. Travis Hutson and state Rep. Demi Busatta Cabrera.