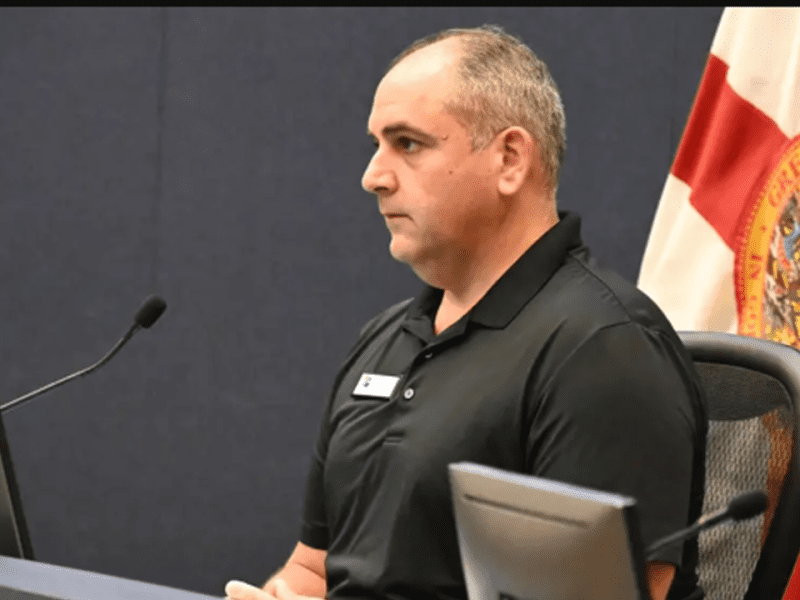

Hillsborough superintendent pitches special property tax for schools

Voters would need to approve such a measure, which could bring $126 million a year into the financially struggling school system.

Tampa Bay Times | By Marlene Sokol | February 3, 2022

Hillsborough County school superintendent Addison Davis has asked a district advisory committee to consider supporting a special property tax for schools, and to make its decision quickly.

“The sooner, the better,” he said.

The citizens budget committee, which formed last summer to advise the School Board, listened to Davis at its meeting Wednesday night but did not make a formal decision. Some members said they agreed with the need for a tax, although one questioned whether the school district has the credibility it needs to ask for more money. Others wanted more streamlined information about finances.

Davis proposed asking voters for a tax of $1 for every $1,000 of real estate value, beyond the local impact tax rate already set by the state. That works out to an additional $200 for a home assessed at $200,000 after the homestead exemption is applied.

Davis said that at a time of 4,100 teaching vacancies statewide, the new money “would really allow us to focus on recruitment and retention of a diverse workforce, to be able to properly compensate all of our employees.”

Smaller schools would have their own music and art teachers instead of sharing them, he said. More mental health counselors could be hired. And the district would have better funding for the equipment needed for science, technology, engineering and math programs, and to meet the needs of children who learn visually.

Unfunded or partly funded state mandates also are an issue. For example, Davis said, the state provides $10 million a year for safety and security measures that were written into law after the 2018 mass shooting at Marjory Stoneman Douglas High School in Parkland. To comply with those mandates, he said, the district must spend $23 million.

The proposed tax, which voters would be asked to renew every four years, would bring in an estimated $126 million a year to cure spending deficits that have climbed to almost $100 million. That deficit this year is projected to grow as high as $111 million if the district does not implement substantial spending cuts.

Two Tampa Bay area districts have a special property tax for schools. Pinellas County voters approved one in 2004 and have renewed it every four years since, with 80 percent voting for it in the November 2020 election. Hernando County voters approved their special school tax for the first time in 2020.

In Hillsborough, a third large package of COVID-19 relief money is expected from the federal government, and was not reflected in the budget projections. That money will pad the main reserve, which is again in danger of falling below state-required levels. But it will not cure the spending deficit.

The reserve is a point of contention between the district and its teachers, who do not have a current contract more than halfway through the school year. Union leaders have argued that, given a level of state funding they describe as insufficient, the district should not hold money in reserve that could be spent in the schools.

But district leaders say a healthy reserve is necessary in case of a catastrophic event, such as a hurricane. The $147 million reserve that the district posted when the books closed in June might sound like a lot of money, said budget manager Susan Garcia. But it “wouldn’t be enough to pay our bills for a month.”

Nor would it satisfy the investment community. In recent years, the district has seen its credit ratings drop because of spending deficits and low reserves, and those lower ratings make it more difficult to borrow.

Budget officials warned that if the reserve drops low enough — especially the portion not earmarked for specific types of spending — the district can once more find itself in danger of a financial takeover by the state.

The citizens committee has spent the last several months gathering information about finances and is now forming subcommittees to investigate specific topics such as staffing, which consumes the greatest share by far of a budget of more than $3 billion.

Some committee members said they were not sure if Davis wanted to move on the real estate tax in time to have it on this November’s ballot. But in a text later to the Tampa Bay Times, Davis said, “I believe there is a need to do so.”

If the tax is approved, collections would begin in 2023 — meaning the district still must cut costs and wait for COVID-19 money to get through the current budget year.

As for the political viability of passing such a tax, Davis said he expect voters will take encouragement from the new half-cent sales tax, which in his opinion has been spent responsibly on air conditioning and other infrastructure projects.

The committee will meet next in early March.