Hillsborough schools tax referendum gets backing of citizens group

Without the extra revenue, the district will struggle to keep up with salaries in neighboring communities, superintendent Addison Davis says.

Tampa Bay Times | By Marlene Sokol | May 5, 2022

A citizens’ committee has voted to endorse a proposed real estate tax to help the Hillsborough County public schools pay competitive salaries and enhance special programs.

The advisory group, which formed last summer, had at first held off on making a formal recommendation while its members studied the district’s budget of more than $3 billion and worked to understand its chronic spending deficits.

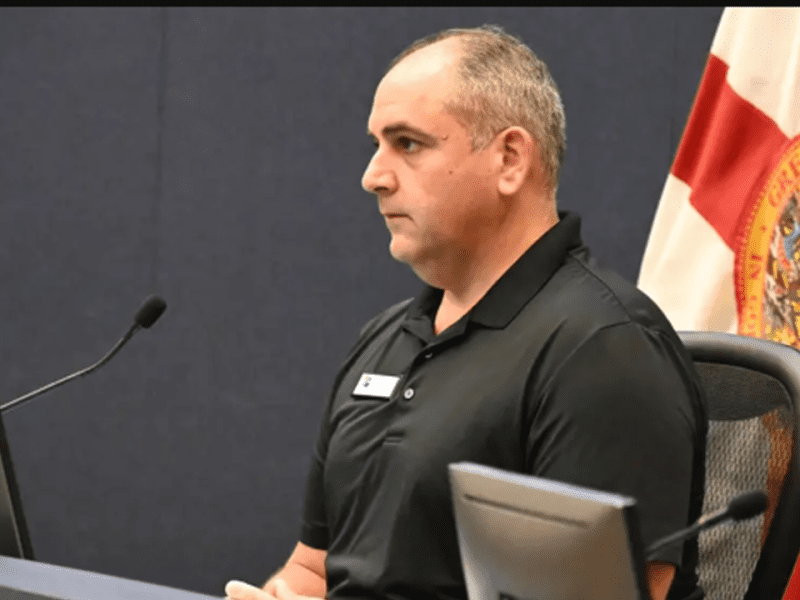

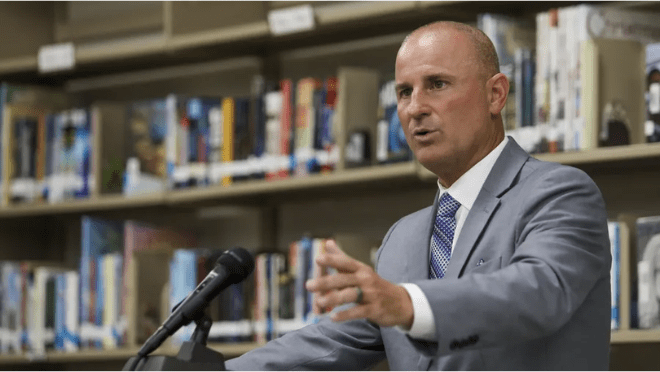

Superintendent Addison Davis, appearing at the committee’s Wednesday’s meeting, appealed to them, as he has in the past, to endorse the tax of $1 on every $1,000 of assessed real estate value.

A growing number of districts around the state, including Pinellas and Hernando County schools, have turned to local option property taxes to augment their state allotments that they contend have not kept up with expenses.

With neighboring Pasco County now in a campaign for its own schools millage tax, Davis said Hillsborough is under more pressure to keep up with teacher pay in the surrounding districts.

Proceeds from the tax would go toward higher salaries and allow the district to expand its instruction in elementary arts and physical education, career education and other programs.

In promoting the tax, district leaders are trying to make two seemingly contradictory points: That they need the money to avoid the operating deficits they have experienced for close to a decade, and that they have taken steps under Davis’ leadership to get spending in line while keeping enough money in reserve to satisfy state law.

“If we don’t get the (tax approved), will we be okay?” said Davis, the superintendent since 2020. “The answer is yes. We will hit the 3 percent threshold (required for the reserve) for years to come.”

But, without the tax, he said, ”we will not be able to structure the financial compensation packages that surrounding counties have done. And that becomes my inability to fill positions in this district to support children.”

Earlier in the day, the Hillsborough County Commission voted 5-2 to allow the schools tax referendum to appear on the Aug. 23 ballot.

Davis told the advisory group that since the School Board approved the measure in April, he and his team have been working to educate principals and other staff on points they will use in the campaign. He predicted strong support for a grassroots campaign will come from the ranks of Hillsborough’s 24,000 employees.

He said he is meeting with business and civic organizations “because we’ve got to have some of our civic leaders who will stand with us and behind us in this process publicly.” A political action committee and a nonprofit organization are being formed, he said.

Davis acknowledged that, in the current economy, the timing for such a measure is not ideal.

But he and union leaders contend the need is genuine. Staffing shortages have depleted the schools of people who teach special needs students, work in front offices, serve lunch and sweep floors.

“We are paying and offering teachers a couple of hours, additionally after their day, if they want to stay and clean their classroom,” Davis said. “That’s how bad it is.”